News

- Details

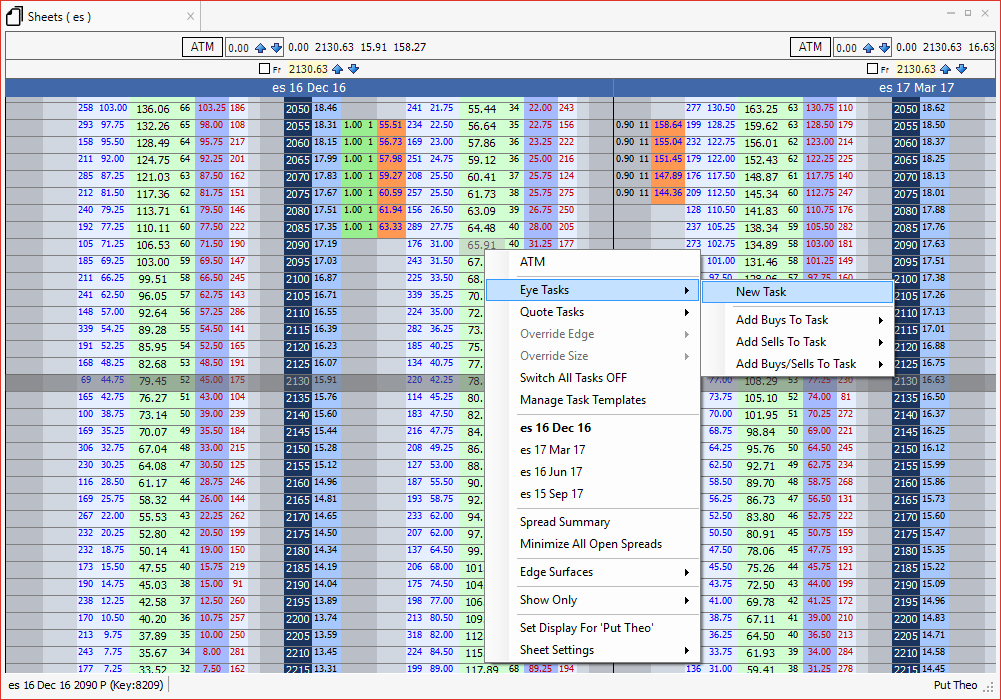

The BTS Electronic Eye feature is a robust resource that enables users to take advantage of specific market conditions by allowing trade and multiple task automation. Built on the same interface as BTS Quoter, traders enjoy the feature’s ease of use, user-generated templates and customizable parameters.

The Electronic Eye function allows traders to automate tasks set for a desired edge as well as customize a trade’s size and price. With safety features in place, this easy to use function enables users to build tasks from an expandable list of securities based on various factors such as the theoretical value, the strike price as well as the bid or offer. Once the task price crosses the theoretical value, the price is highlighted in orange for clear viewing.

The Electronic Eye feature also allows traders to leverage user-generated templates with existing values when a new task is created. Multiple tasks can be sorted by column, filtered based on the type or limited to the ones turned on. Users can also view a detailed summary of created tasks or review the log of events.

The Electronic Eye function is one of many powerhouse features in the BTS platform. If you are interested in learning more about how BTS Edge can work for you, please feel free to contact us with questions or to schedule a demo of our system.

- Details

Blue Trading Systems' Managing Partners Taha Afzal and Kevin Darby will be attending the FIA Boca conference this week. If you would like to enhance your trading strategies, accelerate your quoting times or simply have a beer with us, let us know.

With low latency and agile software solutions, we provide options market makers and proprietary trading firms forward-thinking resources that meet today's demanding markets. Our feature updates are seamless, our customer service is responsive and our success is dependent on your success.

We look forward to hearing how we can help you maintain that competitive edge as well as your position as a market leader in the derivatives space.

Click here to schedule a meeting!

- Details

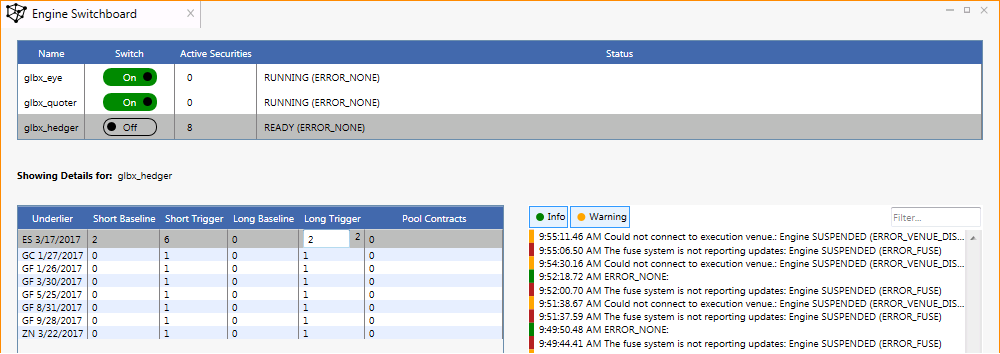

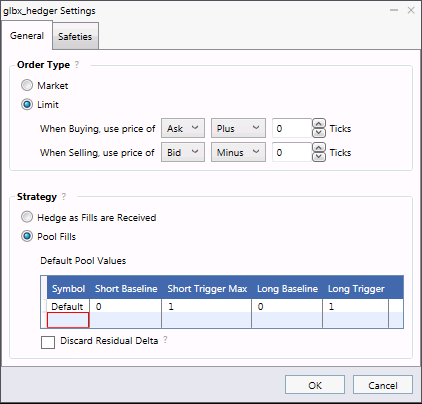

The BTS Auto Hedger automatically hedges electronic trades executed through the BTS Edge system. Our Auto Hedger’s operation is customizable in several ways including the order type to use, the hedging strategy employed and what safeties checks should be enforced. We'll briefly touch on the hedging strategies here.

The simpler of two hedging strategy options is to immediately fire a hedging order for any option fill with sufficient delta. Using this strategy, any fill with less than the required delta will be ignored.

The Second option is our new delta pool Auto Hedger. With the delta pool hedger, the delta from every trade of a hedging security adds to the tally of the delta to be hedged. This continues until the pool reaches the specified size. Once the delta pool is full, the hedger fires either a limit or market order to bring the pool back to the configured baseline.

To learn more about our delta pool hedger and how it can work for you, click here to email or call us and we will be happy to answer your questions or give you a demo.

- Details

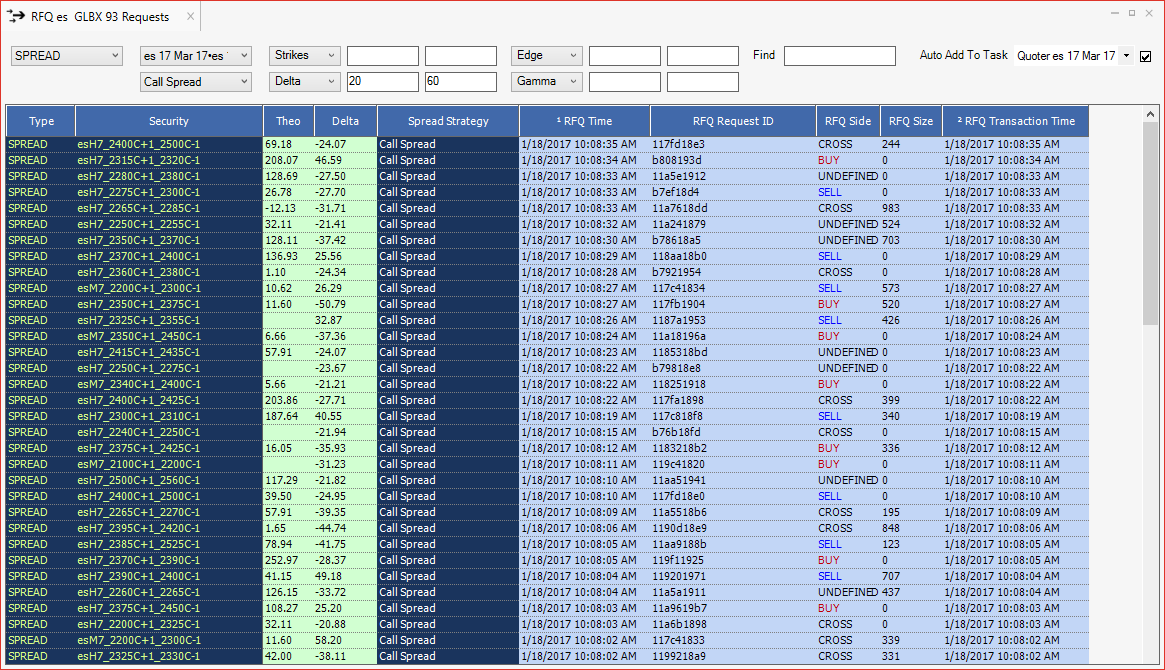

“How can I quote a spread that doesn’t exist yet?” “How can I respond to demand for call spreads with a Delta between 20 and 60 at a particular edge level?”

With BTS Edge you can automatically make a market on new spreads when they are added to the exchange, or respond automatically to an RFQ message indicating customer demand. The all-new auto RFQ response module is built atop our innovative and trusted electronic tasking system.

Configuring Auto RFQ response is as easy as filtering the table of existing RFQs and specifying a target task. You can filter based on any combination of security type, symbol, expiration, spread type, and a specified range of Strikes or Greeks. Once you have a filter specified you simply select an existing task from the drop-down and check the box to verify. Now any new RFQs that match the rule will be automatically added to the task, and you can create as many rules as you need.

If you are interested in learning more or would like a demo of Blue Trading Systems’ software click here to contact us.

Have a Question?

Chicago

318 W Adams St

Suite 1724

Chicago, IL 60606

Telephone: (919) 913-0850

Chapel Hill

194 Finley Golf Course Road

Suite 100

Chapel Hill, NC 27517

Follow Us

Email: info@bluetradesys.com

Twitter: @bts_software

LinkedIn: Blue Trading Systems

Facebook: Blue Trading Systems