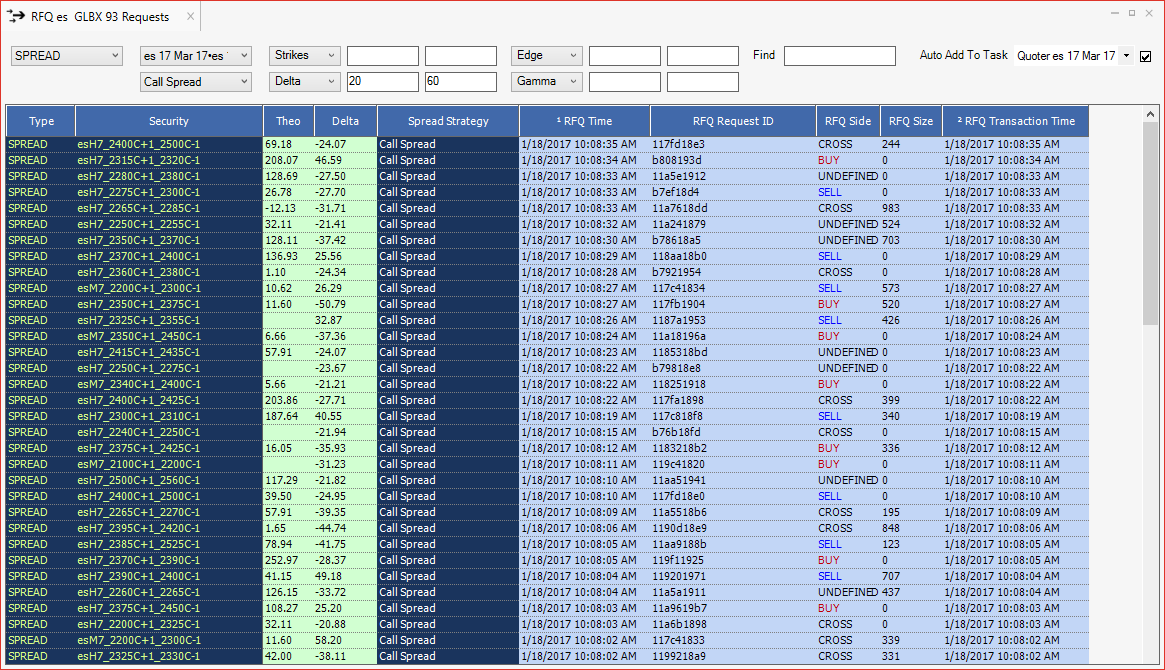

“How can I quote a spread that doesn’t exist yet?” “How can I respond to demand for call spreads with a Delta between 20 and 60 at a particular edge level?”

With BTS Edge you can automatically make a market on new spreads when they are added to the exchange, or respond automatically to an RFQ message indicating customer demand. The all-new auto RFQ response module is built atop our innovative and trusted electronic tasking system.

Configuring Auto RFQ response is as easy as filtering the table of existing RFQs and specifying a target task. You can filter based on any combination of security type, symbol, expiration, spread type, and a specified range of Strikes or Greeks. Once you have a filter specified you simply select an existing task from the drop-down and check the box to verify. Now any new RFQs that match the rule will be automatically added to the task, and you can create as many rules as you need.

If you are interested in learning more or would like a demo of Blue Trading Systems’ software click here to contact us.