At Blue Trading Systems we have built successful derivatives trading systems for more than two decades. We are proud to continue our commitment to engineering excellence with Spark: an algorithmic futures trading system designed for speed, control, extensibility, and reliability.

Spark algos respond to market events in microseconds, giving our users better fills. Spark also allows users to create simple, fast algos without writing code through our Algo Studio. Users with more complex needs can create their own algos using our APIs, all while retaining control over their source code and IP.

Spark is supported by a responsive team with one goal: complete customer satisfaction.

We have learned through experience that speed and flexibility are paramount and that traders should control the timing of

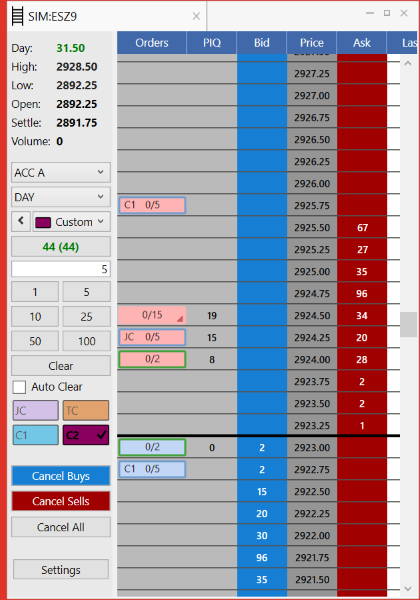

Our intuitive interface is designed to help you zero in on opportunities and execute consequent trades naturally. Our platform provides a solid technological foundation for Proprietary Trading Groups, Commodities Houses and Brokers alike, with a view toward streamlining trading workflow.

Our user interface allows you to:

318 W Adams St

Suite 1724

Chicago, IL 60606

Telephone: (919) 913-0850

194 Finley Golf Course Road

Suite 100

Chapel Hill, NC 27517

Email: info@bluetradesys.com

Twitter: @bts_software

LinkedIn: Blue Trading Systems

Facebook: Blue Trading Systems