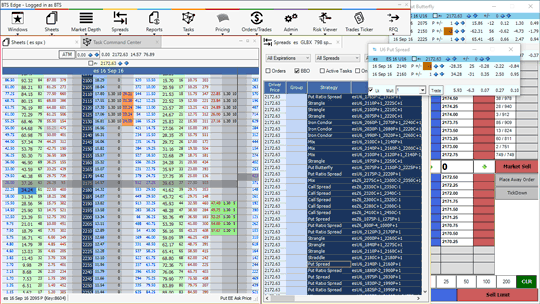

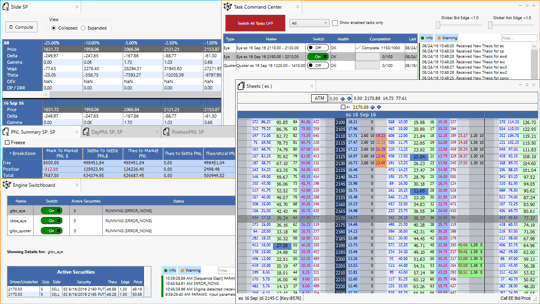

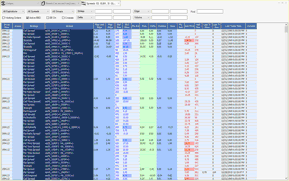

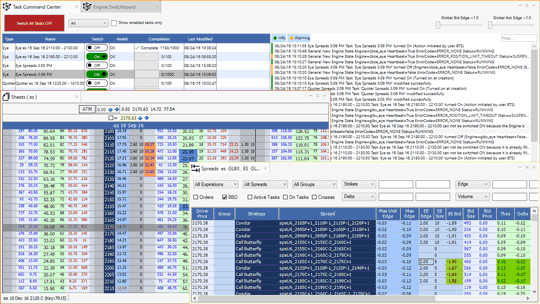

BTS delivers comprehensive, high-performance trading solutions to professional options traders.

Our advanced trading system has successfully weathered many market cycles, often in extreme

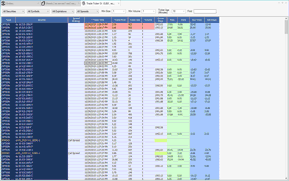

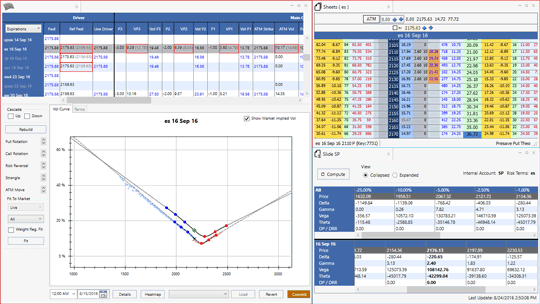

conditions. We offer an intuitive user interface which both assists with trading decisions

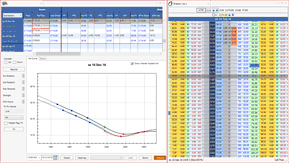

and scours the market for opportunities. The flexibility in setting volatility curves to

reflect true market value leads to reliable prices and realistic, accurate risk reports.

Together, these tools provide a solid technological foundation for market makers, proprietary

trading groups, and brokers alike.

Our support team is made up of industry veterans who understand the urgent nature of this

business, as well as the notion that technology issues can be expensive and time-consuming.

Critical production issues receive immediate attention from the support, engineering, and

management.

Our tenure as a trading firm is part of our DNA. We build practical, efficient solutions

to the complex problems presented by today’s capital markets. We take pride in our work and

hold ourselves to a high standard of quality.