BTS Algo Studio is a high performance, low latency library that enables traders to fully customize their trading style. Within the robust, recently-launched BTS Algo Studio, traders have the ability to combine basic algo building blocks together as well as compose their own algos written through the BTS API. We sat down with BTS Sales Director Brian Muhr to learn more about the customization capabilities, who would benefit most from leveraging this resource and how speed played a role in the development of BTS Algo Studio.

BTS Algo Studio is a high performance, low latency library that enables traders to fully customize their trading style. Within the robust, recently-launched BTS Algo Studio, traders have the ability to combine basic algo building blocks together as well as compose their own algos written through the BTS API. We sat down with BTS Sales Director Brian Muhr to learn more about the customization capabilities, who would benefit most from leveraging this resource and how speed played a role in the development of BTS Algo Studio.

“BTS recently introduced BTS Algo Studio to further enhance a trader’s ability to create their own complex algos,” said Muhr. “What we find most interesting about the algo studio is that you can combine basic algos to create your own complex algos with the same latency profile as our spreader.”

Brian Muhr works closely with BTS’ industry leading clients to understand their needs and high standards when selecting a front-end system to trade futures products. He sees how the traders are leveraging Algo Studio and some of the benefits they incur.

“This is an essential tool for traders where position in queue is critical to their trading as well as those who require full customization of algos,” said Muhr. “The idea that you can combine algos together to accomplish exactly what you are looking to do is significant to today’s professional traders. Also, Being outside of the cloud; BTS Spark offers you the security of full control over your intellectual property.”

BTS keeps speed in mind while developing resources from the ground up and Muhr says that this is no exception.

“That’s the best thing. Algo Studio has the same ultra low latency footprint that BTS is known for, which is by far and away the fastest in the industry for out of the box solutions,” he said.

BTS has boasted a new BTS Spark platform for trading futures that provides control and transparency while keeping proprietary algorithms private. This includes an average of 5 to 15 microsecond requote on the futures spreader and the BTS Algo Studio.

“The BTS Algo Studio comes with both BTS Spark and BTS Spark Lite,” said Muhr about the two wildly successful futures platforms BTS currently offers . “It is available in both versions but the number of algorithms vary per version.”

Muhr explained that he has seen demand for BTS Algo Studio due to the full customize-ability it provides traders over their trading style while giving them the lowest possible latency.

“Custom algos can be created by combining algos already in the Spark platform; both built-in and those created via our C++ server side API,” said Muhr. “The currently available algos are Lean, Join, Top, Cover, and OCO among others.”

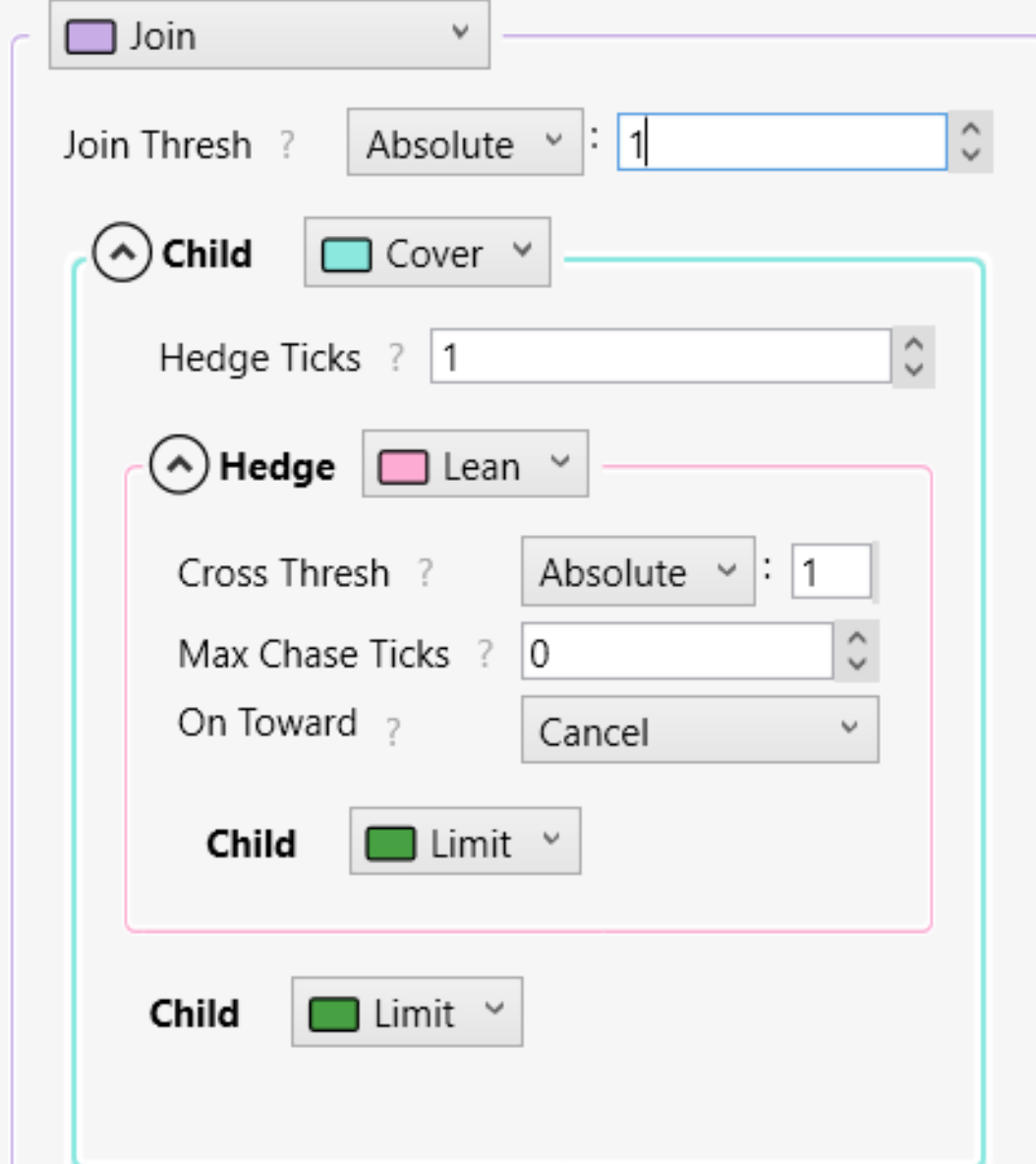

He was able to give an example of how to take advantage of the market when the best offer becomes the best bid, or best bid becomes the best offer leveraging the “join” algorithm.

“If you are trading a particular market and you only want to “join” the market when it flips, this can be accomplished with our join algo,” he explained. “The threshold parameter of the join algo sets either the absolute volume required to join after the flip, or the ratio of your order size to the remaining volume after the flip.”

The join algo can send an additional order after being filled by setting the child order to cover. The cover order will be placed the specified number of ticks away from the initial order.

“Finally, you can use a lean order type as your cover and thus lean back into the market for your hedge,” he said.

Muhr admits this may sound like a lot, however, it can be accomplished quickly with a few clicks.

“We are always trying to accomplish trading tasks with the fewest clicks as we know our client base well and this is an absolute requirement,” he said.

“On the top of the algo studio, you can set the name, abbreviation and color for your custom algo. The abbreviation and color are used if you have quick launch buttons displayed in the ladder,” said Muhr. “Quick launch buttons can be displayed for any or all of your custom algos from the ladder display settings.”

In conclusion, Muhr emphasized the compose-ability and level of customization that BTS Algo Studio provides through the C++ server side API.

“You can write your own algos and plug them into BTS,” said Muhr. “Once put into our system they appear as another order type, which can then be composed with other algos within the algo studio.”

BTS strives to maintain an open dialogue with users and listens to what their customers need to enhance their futures trading experience. If you would like to test drive BTS Algo Studio, please email This email address is being protected from spambots. You need JavaScript enabled to view it. to set up a demo.