Spreader

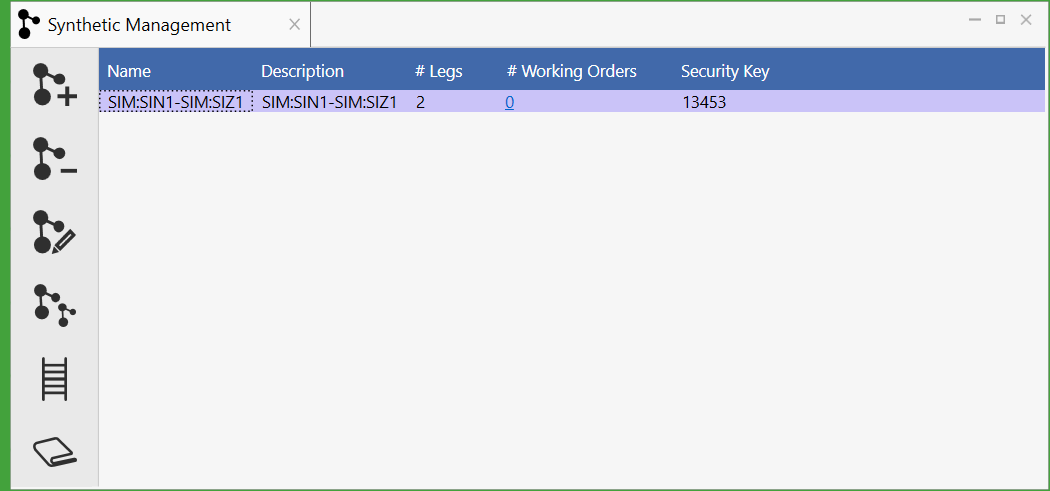

- Launching the spreader from the module launcher will bring up the synthetic management browser which appears like below:

-

From this window, it will show any synthetics that you have already created as well as various other options of both managing the synthetics and other tasks all from the left-hand side pane within the window, including:

- Adding a new synthetic

- Removing a synthetic

- Changing a synthetic

- Cloning a synthetic

- Launching a ladder of a highlighted synthetic

- Launching an order book of selected synthetic

- Adding a new synthetic

Creating a synthetic🔗

-

Bringing up a synthetic browser to create a new synthetic can be done from a number of ways:

- From the main module launcher, you can go to spreader, then synthetics, then click add

- Highlighting one or more securities in a market view and clicking on Create Synthetic

- Cloning an existing security

-

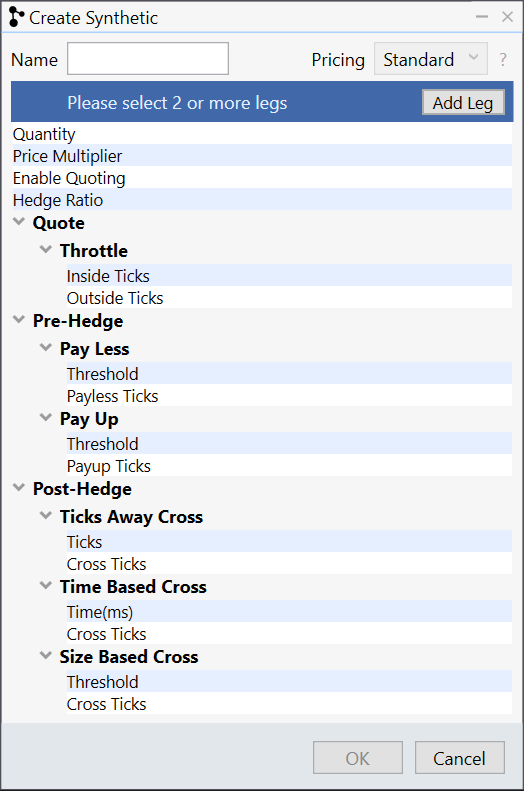

An empty synthetic browser will look like below without any legs chosen:

-

Clicking on Add Leg on the top right of the window will launch the security browser, which will allow you to choose the first leg

-

Upon adding legs, you can then go through each of the parameters to customize how you would like the spread to be worked in the market

-

We will start at the top of the Create Synthetic window and work our way down:

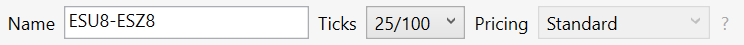

- At the very top of the Create Synthetic window you will have to name your synthetic product. By default, it will auto-populate based on the symbols you have chosen:

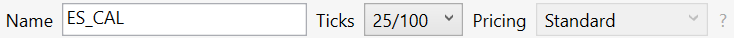

- You can click into the text box to the right of the name and customize the name to be whatever you would like, we’ll call this ES_CAL:

- Also included on this row are what ticks you would like this to be priced in as well as the format of the pricing

- Moving down within this window, you’ll see the symbols you have chosen which you can remove by clicking on the X to the left as well as the option to add additional legs through the add leg box to the right of the symbols:

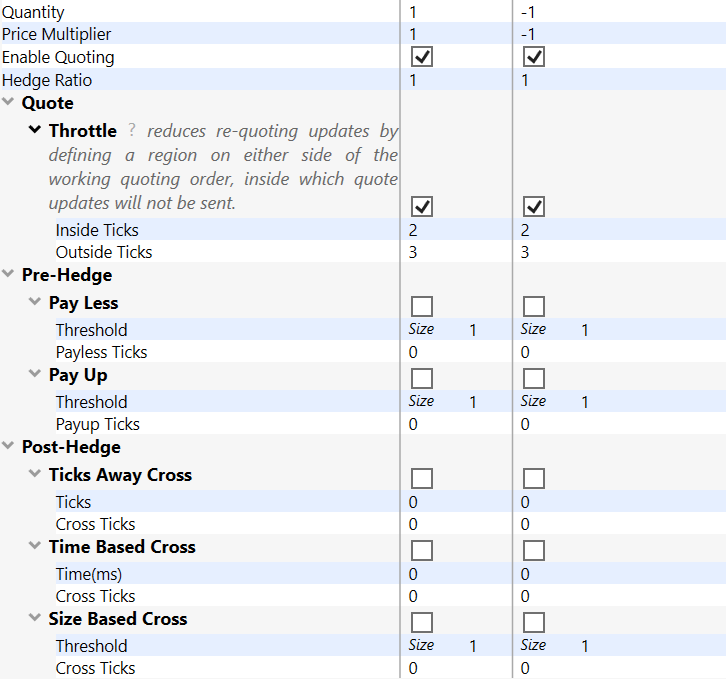

- The following rows are all part of the main parameters which can all be modified according to the traders style of designing the synthetic and how it will be priced as well as worked at the exchange

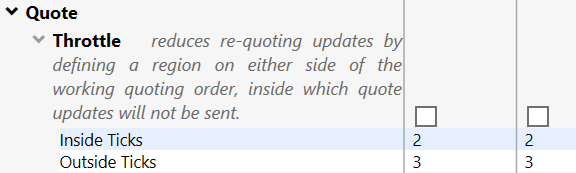

- Furthermore, if you are ever unsure of what a parameter’s function is and how it is controlled you can hover over the parameter’s title and a “?” will be shown. Clicking on this will expand built-in details of how that parameter functions. Below is an example of the throttle details displayed:

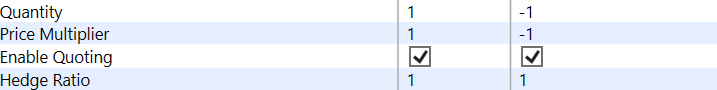

- Main parameters - these are the top 4 rows in the Create Synthetic window which all synthetics will be required to have set. Everything below these can be customized to a trader's needs, however, the top 4 are the main foundational aspects used for the calculation of the synthetic:

- Quantity - This is the number of contracts of the security you would like to be included in the calculation of the synthetic as well as a buy or sell. By default, the first leg will come up as a buy and the second leg a sell. Sells are represented “-1”

- Price multiplier - This is multiplier at which the synthetic will be priced, by default, it’ll be based on the same as the quantity of the synthetic produced, but you can change it to modify the balance of the price, giving more weighting to one leg over another.

- Enable quoting - This parameter is in the form of a checkbox, where if the box is checked the leg will be quoted versus not checked, it will not be shown in the market. If it is not actively quoted in the market, the leg will still be used for calculation of the entire synthetic.

- Hedge ratio - This is the ratio multiplier that defines how much volume you require in that leg before leaning off it. For example, if you are looking to buy 4 ES and sell 2 NQ, if your hedge ratio is 1, you will work the ES leg at where you could get filled on 2 NQ. If your Hedge Ratio is 3 on the NQ leg, then you’ll work the ES order based on where you could fill 6 (2 (Qty of NQ) * 3 (Hedge Ratio)).

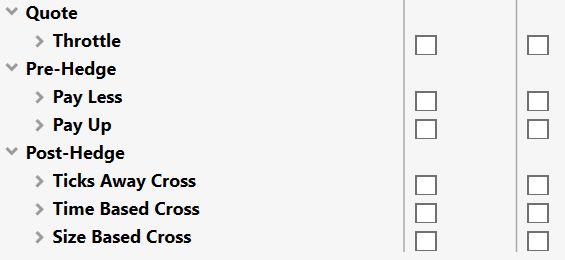

- The next 6 parameters are all completely custom to a trader's needs and can further define how a synthetic is worked. As previously mentioned, if you hover over any of these parameters a “?” will be displayed and click on such will display further details on how this parameter is used:

-

Quote

- Throttle - This can be enabled or disabled based on if the box is checked per leg. Its main function is to reduce re-quoting updates by defining a region on either side of the working quote order, inside which quote updates will not be sent:

-

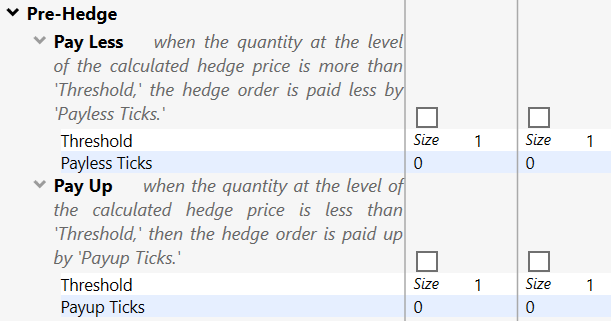

Pre-Hedge

- Pay Less - If enabled by checking the checkbox, the spreader will attempt to pay less when the quantity at the level of the calculated hedge price is less than the threshold defined. The hedge order is paid less by the “Payless Ticks” as defined per leg.

- Pay Up - If enabled by checking the checkbox, the spreader will pay up when the quantity at the level of the calculated hedge price is more than the threshold defined. The hedge order will pay up by the “Payup Ticks” as defined per leg.

-

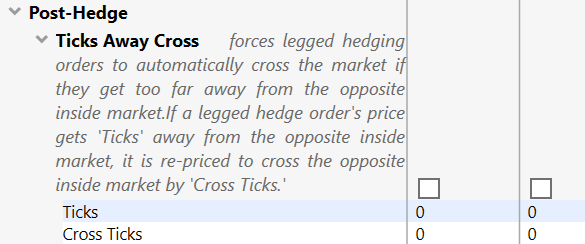

Post-Hedge

- Ticks Away Cross - If enabled by checking the checkbox, the spreader will force hedging orders to automatically cross (fill) the market if they get too far away from the opposite inside market. If a legged hedge order’s price gets X amount of “ticks” away from the opposite inside market, it is re-priced to cross the opposite inside market as defined by “cross ticks”

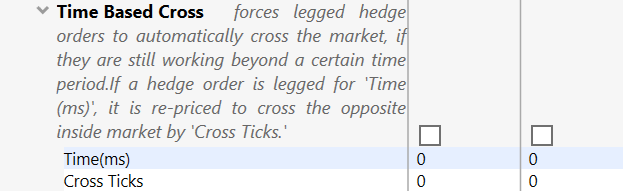

- Time Based Cross - Basically the same as Ticks Away Cross, however, this is based on time (in ms) on when to automatically cross (fill) the market if they get too far away from the opposite inside market. If a legged hedge order’s price gets X amount of “ticks” away from the opposite inside market, it is re-priced to cross the opposite inside market as defined by “cross ticks”

- Size Based Cross - similar to ticks and time based cross, but based on size instead. If you define a threshold of the opposite inside market and it drops below that threshold, it’ll automatically cross the market. If a legged hedge order’s price gets X amount of “ticks” away from the opposite inside market, it is re-priced to cross the opposite inside market as defined by “cross ticks”